ProjectManager offers an award-winning Gantt chart feature that lets you.

Budget planning chart how to#

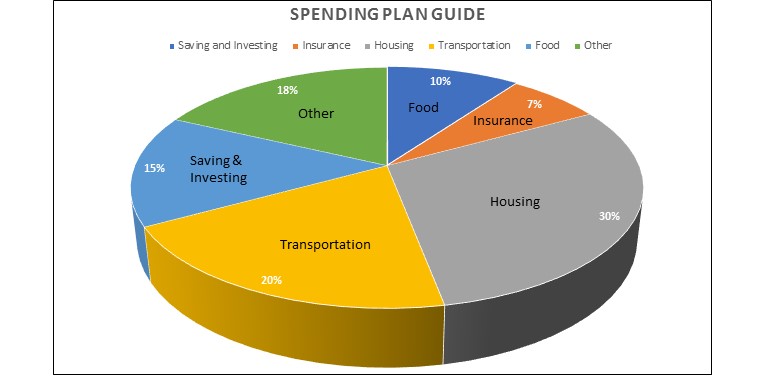

Learn how to budget and create a spending plan. Thats where budget management comes in, during the project planning phase. You can then make realistic assumptions about your annual income and expense and plan for long term financial goals like starting your own business, buying an investment or recreation property or retiring. Using a realistic budget to forecast your spending for the year can really help you with your long term financial planning.

Budget planning chart free#

You can then look for ways to even out the highs and lows in your finances so that things can be more manageable and pleasant.Įxtending your budget out into the future also allows you to forecast how much money you will be able to save for important things like your vacation, a new vehicle, your first home or home renovations, an emergency savings account or your retirement. Five free budget templates for event planning and budgeting are available in Excel. Our phone number is 0 8 0 0 1 3 8 1 1 1 1. However if you use a screen reader and require debt advice you may find it easier to phone us instead.

We aim to make our website as accessible as possible. Get free expert advice from StepChange, the leading UK debt charity. By doing this you can easily forecast which months your finances may be tight and which ones you'll have extra money. How to make a budget plan - use free tools and templates to manage your money. Once you create your first budget, begin to use it and get a good feel for how it can keep your finances on track, you may want to map out your spending plan or budget for 6 months to a year down the road. Take the Pain Out of Budgeting with an Interactive Budget Calculator That Guides You Budget planning schema (optional) An optional but recommended first step is to create a schema that shows your organizations procedure for formulating a budget. What about Budget Forecasting and Planning? Following a budget or spending plan will also keep you out of debt or help you work your way out of debt if you are currently in debt. There are three stages to working out your budget: Look at how much cash youll have coming in at the start of, and during, the term (weve got more on what your incomings do and dont include below ). Since budgeting allows you to create a spending plan for your money, it ensures that you will always have enough money for the things you need and the things that are important to you. We want to help you know exactly where your money is being spent, and how much you’ve got coming in.

0 kommentar(er)

0 kommentar(er)